Computer fixed asset depreciation

When to Classify an Asset as a Fixed Asset. You need to know the full title Guide to depreciating assets 2022 of the publication to use this service.

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition

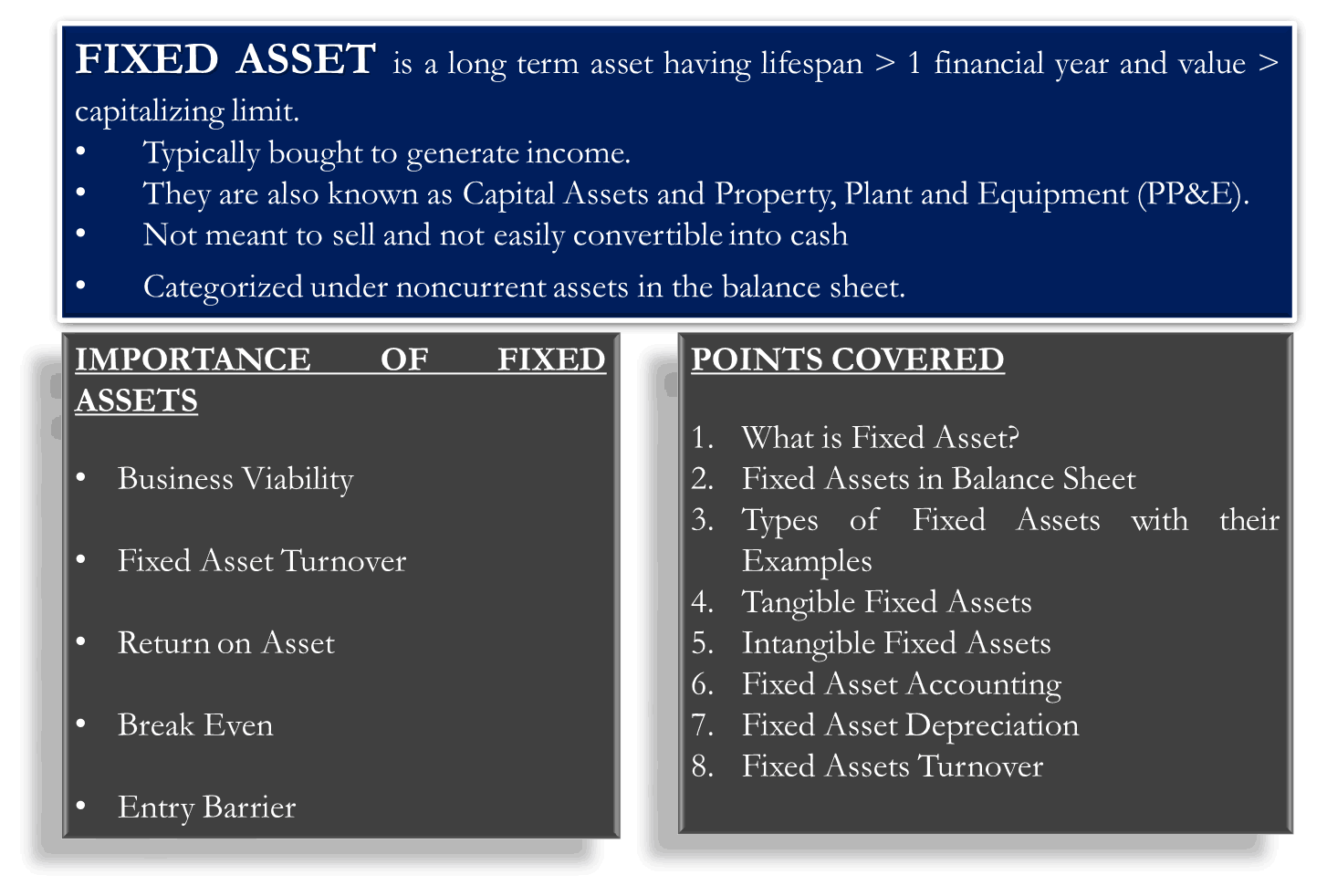

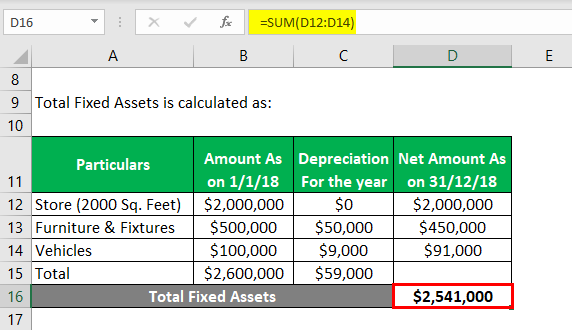

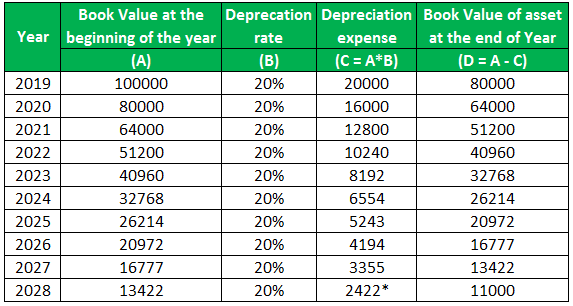

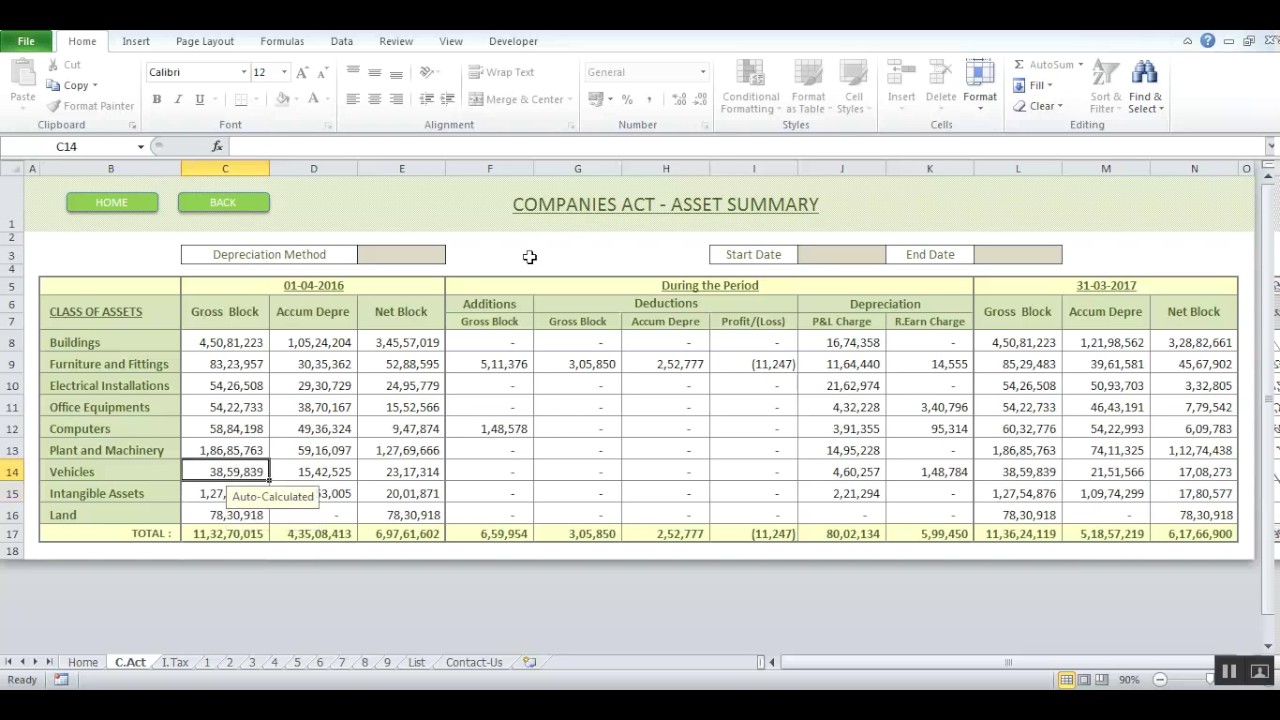

A table is given below of depreciation rates applicable if the asset is purchased on or after 01 st April 2014 and useful life is considered as given in companies act2013 and.

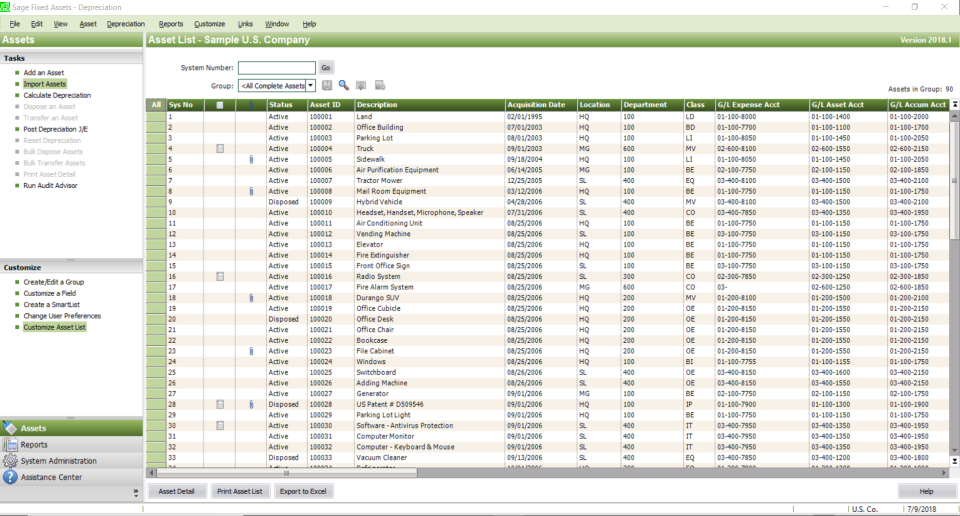

. An offset account is an account in the profit and loss part of the chart of. The DB function uses a fixed rate to calculate the. All-In-One System For Fixed Asset Depreciation Accounting Management And Reporting.

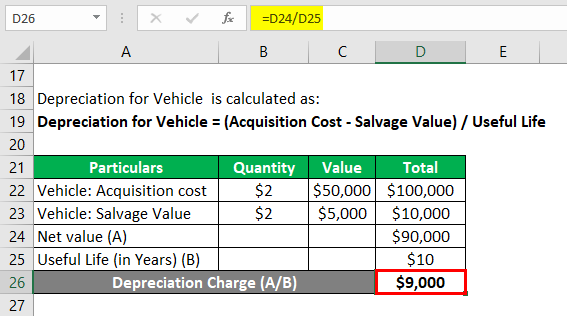

Depreciation rate finder and calculator. You may be able to deduct the acquisition cost of a computer purchased for business use in several ways. The following are the list general categories of fixed assets.

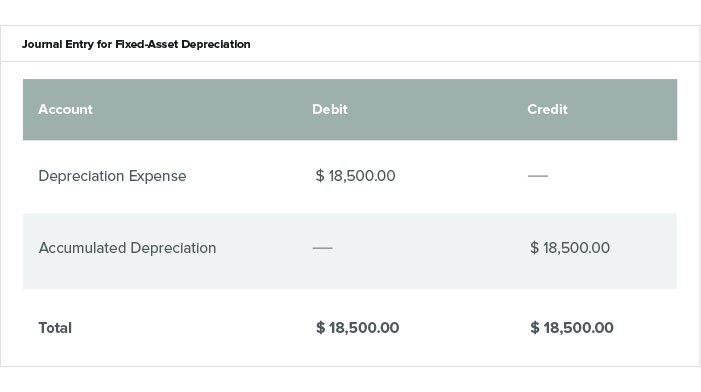

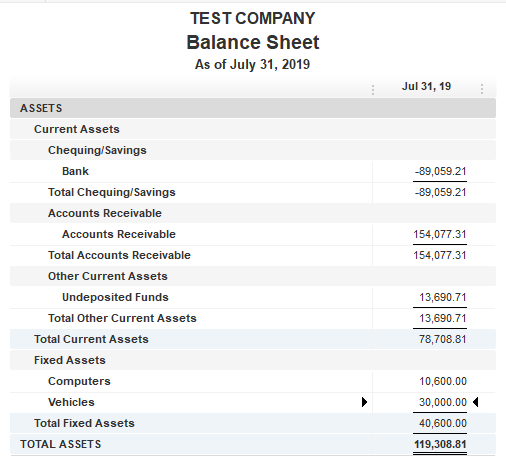

Under Internal Revenue Code section 179 you can expense the acquisition. Their useful life normally longer compared to. Depreciation is a periodic transaction that typically reduces the value of the fixed asset on the balance sheet and is charged as an expenditure to a profit and loss account.

When assets are acquired they should be recorded as fixed assets if they meet the following two criteria. The value of the coefficient depends on the duration of use and the nature of the equipment. It is obtained by multiplying the straight-line depreciation rate by a coefficient.

From the Account Type dropdown select Tangible Assets. Fixed assets also known as tangible assets or property plant and equipment PPEis an accounting term for assets and property that cannot be easily converted into. This limits your tax burden and company losses.

Depreciation is an accounting practice that spreads the loss of value for each of your assets over multiple accounting periods. Most assets lose more value at the beginning of their useful life. Go to the Accounting menu.

Have a useful life of. Find the depreciation rate for a business asset. These include an office building warehouse and another similar kind of.

We help companies recover value from their IT assets securely and responsibly. Select Chart of Accounts. From the Detail Type dropdown choose.

You can use this tool to. The SYD DB DDB and VDB functions apply this property. Ad Fixed Asset Pro Is Continually Updated For The Latest Changes In Tax Depreciation Rules.

Use our automated self-help publications ordering service at any time. Therefore a main account is typically used to credit the periodic depreciation on the balance sheet. Calculate depreciation for a business asset using either the diminishing value.

Ad CNE is a full-service IT asset disposition ITAD partner.

What Are Fixed Assets A Simple Primer For Small Businesses Freshbooks Resource Hub

The Basics Of Computer Software Depreciation Common Questions Answered

Fixed Asset Inventory Report Depreciation Guru

Fixed Asset Journal Entries Depreciation Entry Accumulated Depreciation Youtube

What Is Fixed Asset Type Tangible Intangible Accounting Dep

Fixed Asset Examples Examples Of Fixed Assets With Excel Template

Computer Software Depreciation Calculation Depreciation Guru

Fixed Asset Accounting Made Simple Netsuite

How To Prepare Depreciation Schedule In Excel Youtube

Fixed Asset Register Depreciating Your Assets What You Need To Know

Depreciation Rate Formula Examples How To Calculate

What Are Fixed Assets A Simple Primer For Small Businesses Freshbooks Resource Hub

Top 10 Fixed Asset Management Software Free Paid Softwareworld

How Do I Remove A Fixed Asset An Old Vehicle That The Business No Longer Has From The Balance Sheet

Fixed Asset Examples Examples Of Fixed Assets With Excel Template

Fixed Asset Register Depreciating Your Assets What You Need To Know

Depreciation Calculator For Companies Act 2013 Fixed Asset Register Youtube